Finance Minister Nirmala Sitharaman while presenting the Union Budget for 2021-22 as part of the tax incentives to International Financial Services Centre (IFSC) in GIFT City has proposed tax holiday for capital gains for aircraft leasing companies and tax exemption for aircraft lease rentals paid to foreign lessors.

This move can be considered to be a first step towards creating a domestic aircraft leasing hub in India, since till now, the Indian aviation industry has been dominated by lessors from Ireland, Dubai and Hong Kong due to their attractive tax policies. This move is likely to incentivise leasing companies to set up operations here in the GIFT city and making it a global hub. However, as seen from the past experience from around the world the results may be not be as immediate as expected, Ireland took almost 40 years to be the world’s top aircraft leasing hub. Singapore, too, has invested time and money attracting lessors. Along with providing tax incentives, the government will also need to amend regulations and alter double tax avoidance treaties with other countries to make aircraft leasing business in India a reality. Though tax incentives is a good step towards building this segment in India, the government will need to create a regulatory framework with proper financial structuring so that it could also encourage deep pocketed domestic investment in aircraft leasing business.

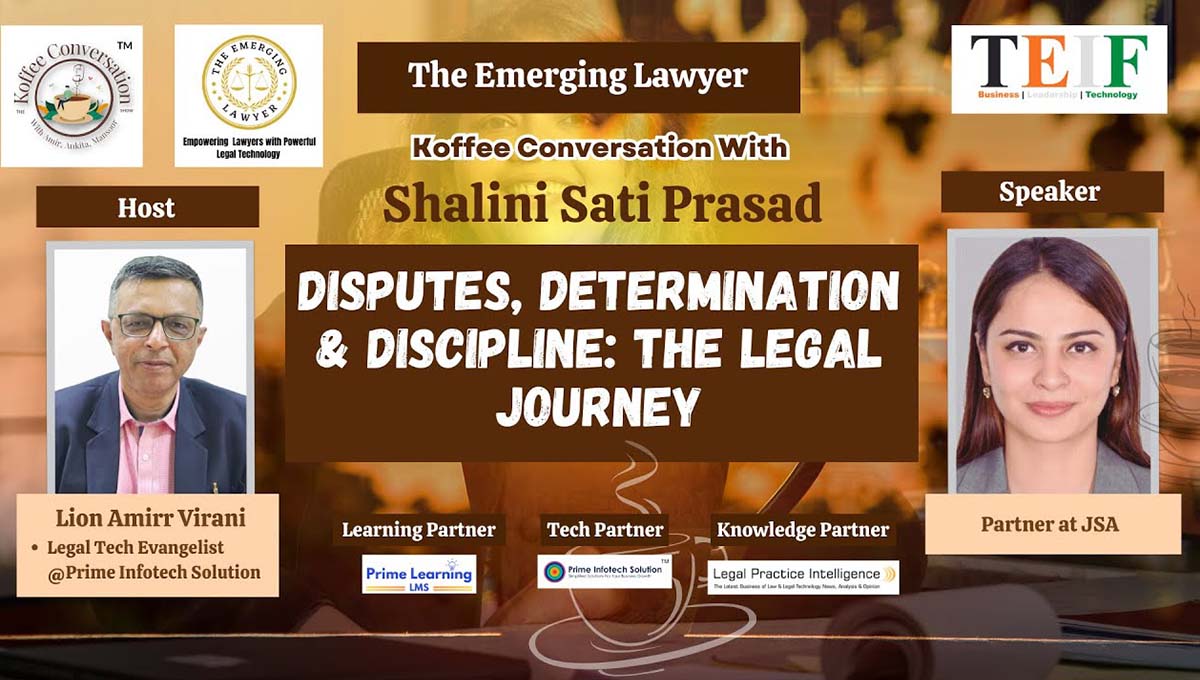

JSA Viewpoint by Poonam Verma.