Avantika focuses on mergers & acquisitions and private equity investments.

She has extensive experience in advising clients in corporate and business restructuring, strategic collaborations and cross-border investments across sectors.

In addition, she has extensive experience in advising on corporate commercial matters and on matters relating to corporate governance.

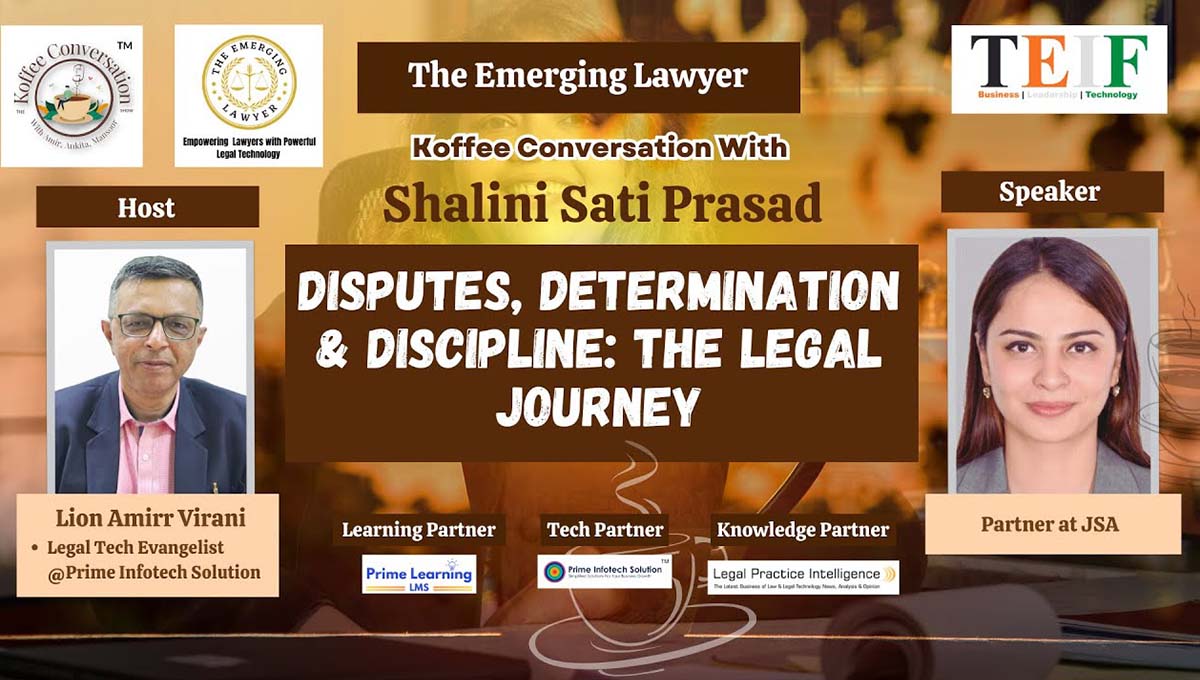

She has been practicing law since 2012. Before joining JSA, she was with Khaitan & Co, Mumbai, one of India’s premier and oldest law firms, for more than four years.

Memberships

Bar Council of Karnataka

Publications

- New rules for overseas investment by AIFs and VCFs, August 2022

- “Are E-cigarettes about to be stubbed out in India” published by IBA Lifesciences Newsletter, September 2019

- “The use of artificial intelligence in the healthcare sector in India” published by IBA Lifesciences Newsletter, January 2019

Education

B.A., LL.B. (Honours), Christ College of Law, Bangalore

Languages

- English

- Hindi